Investment Strategies

Investment strategies are the plans and approaches that individuals, organizations, or funds use to allocate their resources with the goal of achieving financial returns. These strategies can vary widely based on factors such as risk tolerance, financial goals, time horizon, market conditions, and available resources. Here are some common investment strategies:

Long-Term Buy and Hold:

This strategy involves investing in assets (such as stocks or bonds) and holding onto them for an extended period, often many years. The idea is to benefit from the potential for compounding returns over time and to ride out short-term market fluctuations.Value Investing:

Value investors seek out stocks or other assets that they believe are trading below their intrinsic value. They analyze fundamental factors such as earnings, assets, and other financial indicators to identify undervalued opportunities.Growth Investing:

Growth investors focus on investing in companies with strong potential for rapid earnings growth. These investors are willing to accept higher levels of risk in exchange for the potential of significant returns.Income Investing:

Income investors prioritize generating a steady stream of income from their investments. They often invest in assets like dividend-paying stocks, bonds, real estate, or other income-generating securities.Dividend Investing:

This strategy involves investing in stocks of companies that regularly pay dividends to their shareholders. Dividend investors seek to build a portfolio that provides a reliable income stream.Index Investing (Passive Investing):

Index investors aim to match the performance of a specific market index, such as the S&P 500. They achieve this by investing in funds like index mutual funds or exchange-traded funds (ETFs).

Rupee - Cost averaging:

This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. Over time, this approach can help reduce the impact of market volatility and potentially lead to favorable average prices.Market Timing:

Market timing involves trying to predict the direction of the market and making investment decisions based on those predictions. This strategy can be challenging and risky, as accurately timing the market consistently is extremely difficult.Sector Rotation:

Investors employing this strategy shift their investments among different sectors of the economy based on their assessment of the economic cycle. Different sectors perform better in different phases of the economic cycle.Quantitative Investing:

Quantitative investors use mathematical models and data analysis to make investment decisions. This approach often involves complex algorithms and can be applied to various asset classes.Hedging and Risk Management:

Some strategies focus on managing risk and protecting investments from potential losses. Techniques like options trading, diversification, and using hedging instruments can be employed for risk management.Alternative Investments:

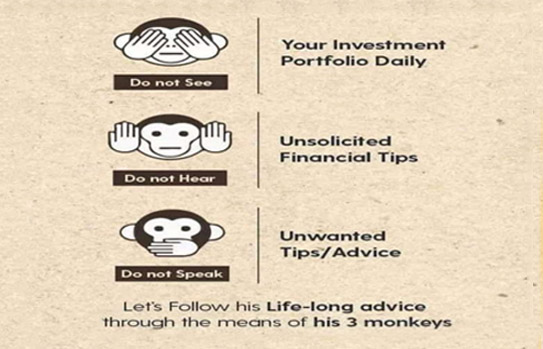

This strategy involves investing in non-traditional assets such as real estate, commodities, hedge funds, private equity, or venture capital. These investments can offer diversification and potentially higher returns, but they often come with higher risks and less liquidity.Remember that no single strategy is suitable for everyone, and it's essential to align your investment strategy with your individual financial goals, risk tolerance, and investment timeline. Many investors also choose to diversify their portfolios across multiple strategies and asset classes to reduce risk and optimize potential returns. Consulting with a financial advisor can provide personalized guidance based on your specific situation and objectives.